Delving into TSN Stock Analysis: Is Tyson Foods Still a Safe Investment in 2025?, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Providing an insightful overview of Tyson Foods, its core business operations, key competitors, financial performance analysis, market trends, forecast, and sustainability initiatives.

Overview of Tyson Foods

Tyson Foods is a multinational corporation that specializes in the production and distribution of meat products. Founded in 1935 by John W. Tyson, the company has grown to become one of the largest food companies in the world.

Core Business Operations

- Tyson Foods operates in four primary business segments: Beef, Chicken, Pork, and Prepared Foods.

- The company processes and markets a wide range of protein-based products, including fresh and frozen meats, as well as value-added food items.

- Tyson Foods also has a significant presence in the international market, exporting products to various countries around the globe.

Key Competitors

- Cargill: A major player in the food industry, Cargill competes with Tyson Foods in the production and distribution of meat products.

- JBS: Another key competitor, JBS is a Brazilian company that is one of the largest meat processing companies in the world.

- Pilgrim's Pride: A leading poultry producer, Pilgrim's Pride is a direct competitor to Tyson Foods in the chicken segment of the market.

Financial Performance Analysis

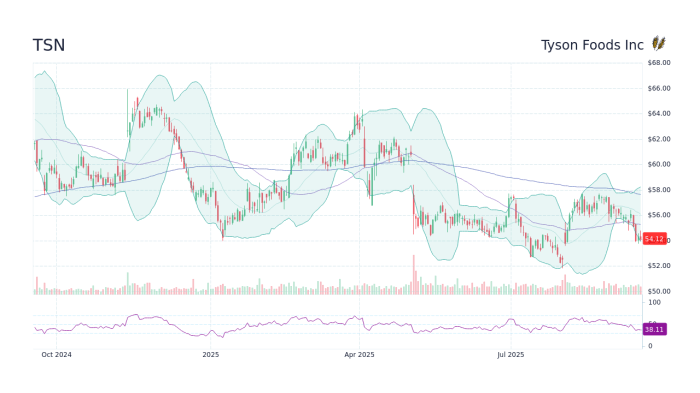

When considering whether Tyson Foods is still a safe investment in 2025, it is crucial to delve into the company's financial performance. By analyzing historical stock performance, comparing financial ratios with industry averages, and reviewing recent financial updates, investors can make informed decisions about the company's future prospects.

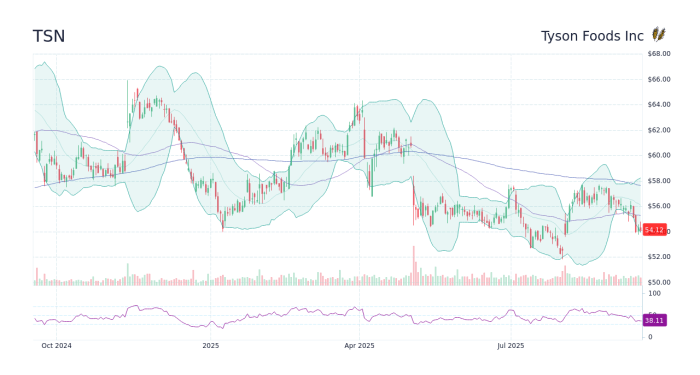

Historical Stock Performance

Over the past few years, Tyson Foods has shown steady growth in its stock performance. Despite facing challenges in the food industry, the company has managed to maintain a positive trajectory, reflecting its strong business fundamentals and strategic decisions.

Financial Ratios Comparison

Comparing Tyson Foods' financial ratios with industry averages provides valuable insights into the company's financial health and operational efficiency. By examining metrics such as profitability, liquidity, and leverage, investors can assess how Tyson Foods stacks up against its competitors and industry standards.

Recent Financial News

In recent months, Tyson Foods has made headlines with various financial updates, including earnings reports, acquisitions, and strategic partnerships. These developments can have a significant impact on the company's stock performance and overall market position, making it essential for investors to stay informed about the latest financial news related to Tyson Foods.

Market Trends & Forecast

In order to determine whether Tyson Foods is still a safe investment in 2025, it is crucial to analyze the current market trends affecting the food industry and forecast the future growth of the company.

Current Market Trends in the Food Industry

- The increasing demand for plant-based and alternative protein products is reshaping the food industry landscape.

- Consumers are becoming more conscious of their health and environmental impact, leading to a shift towards sustainable and ethically sourced food products.

- Technological advancements, such as automation and artificial intelligence, are revolutionizing food production and distribution processes.

Projected Market Growth for Tyson Foods

- Analysts predict that Tyson Foods will experience moderate growth in the coming years, driven by its strong brand presence and diversified product portfolio.

- The company's focus on innovation and sustainability initiatives is expected to resonate with consumers and drive sales growth.

- Expansion into international markets and strategic acquisitions may further contribute to Tyson Foods' market growth.

Potential Risks and Opportunities for Tyson Foods in 2025

- One of the potential risks for Tyson Foods is the volatility of commodity prices, which can impact its input costs and profit margins.

- Changing consumer preferences and increased competition in the food industry pose challenges for the company to maintain its market share.

- On the other hand, opportunities lie in the growing demand for premium and convenience food products, which Tyson Foods can capitalize on through product innovation and marketing strategies.

Sustainability & Corporate Social Responsibility

When it comes to sustainability and corporate social responsibility, Tyson Foods has made significant strides in recent years. The company has recognized the importance of being environmentally conscious and socially responsible in today's business landscape.

Sustainability Initiatives

- Tyson Foods has set ambitious sustainability goals, such as reducing greenhouse gas emissions and water usage across its operations.

- The company has invested in renewable energy sources and has implemented innovative technologies to improve energy efficiency.

- Tyson Foods also focuses on sustainable sourcing practices, ensuring that its supply chain is ethical and environmentally friendly.

Corporate Social Responsibility Efforts

- Recently, Tyson Foods has been actively involved in community outreach programs, supporting local communities and charitable initiatives.

- The company has also taken steps to improve animal welfare standards and has been transparent about its practices in this area.

- Through its Tyson Foods Fellows program, the company provides leadership development opportunities for employees and fosters a culture of diversity and inclusion.

Impact on Reputation and Bottom Line

Tyson Foods' sustainability practices and corporate social responsibility efforts have had a positive impact on its reputation. Consumers are increasingly looking for companies that prioritize sustainability and ethical practices, and Tyson Foods' initiatives in these areas have helped enhance its brand image.

Moreover, investing in sustainability has not only improved Tyson Foods' reputation but has also positively impacted its bottom line. By reducing waste, improving efficiency, and meeting consumer demand for sustainable products, the company has been able to drive growth and profitability.

Closing Summary

In conclusion, exploring the safety of investing in Tyson Foods in 2025 reveals a complex landscape of financial data, market trends, and sustainability efforts that investors need to consider.

Top FAQs

What is the history of Tyson Foods?

Tyson Foods was founded in 1935 and has grown to become one of the largest food companies globally.

How does Tyson Foods compare to its competitors in the food industry?

Tyson Foods faces competition from companies like Cargill and JBS in the food industry.

What are some potential risks for investing in Tyson Foods in 2025?

Some risks include market volatility, regulatory changes, and supply chain disruptions.