Mezzanine Debt Financing: Ideal for Expanding Middle-Market Companies sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As we delve deeper into the world of mezzanine debt financing, we uncover a financial tool that holds great potential for middle-market companies looking to expand and grow their operations.

Definition of Mezzanine Debt Financing

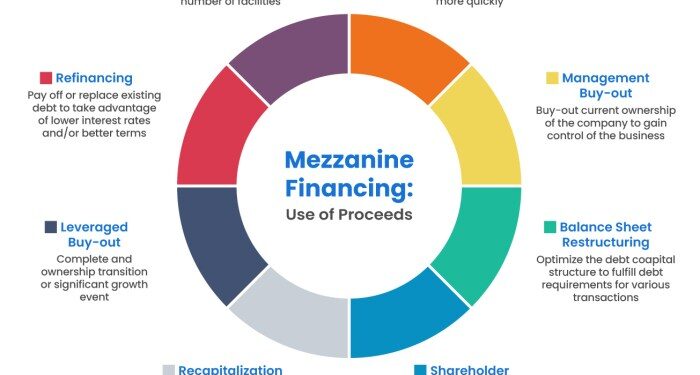

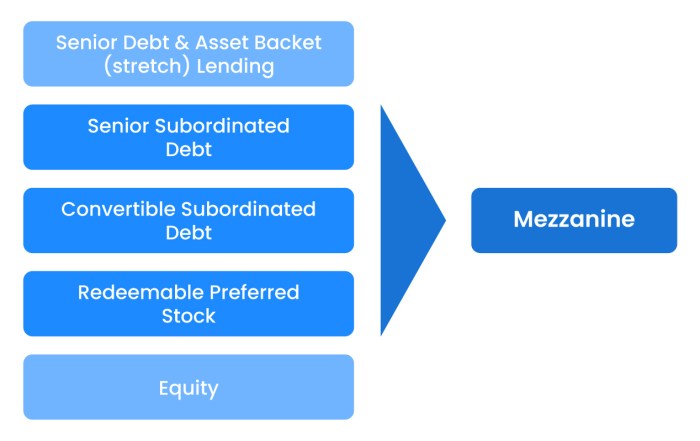

Mezzanine debt financing is a hybrid form of financing that combines elements of debt and equity. It is typically used by middle-market companies looking to expand or finance a specific project. Mezzanine debt sits between senior secured debt and equity in the capital structure, providing a layer of financing that is subordinate to senior debt but senior to equity.

Examples of Situations Where Mezzanine Debt Financing is Commonly Used

Mezzanine debt financing is commonly used in situations where a company requires additional capital beyond what traditional bank loans can offer, but does not want to dilute existing ownership through equity financing. For example, a middle-market company looking to fund an acquisition, expand operations, or undertake a management buyout may turn to mezzanine debt financing.

Key Features and Benefits of Mezzanine Debt Financing for Middle-Market Companies

- Flexible Terms: Mezzanine debt typically offers more flexible terms compared to traditional bank loans, allowing companies to tailor the financing to their specific needs.

- Higher Leverage: Mezzanine debt allows companies to achieve higher leverage ratios without diluting ownership, making it an attractive option for growth-oriented companies.

- Equity-Like Returns: Mezzanine debt providers often receive equity warrants or profit participation, providing them with the potential for higher returns compared to traditional lenders.

- Growth Catalyst: Mezzanine debt can serve as a catalyst for growth, providing companies with the capital needed to pursue strategic initiatives and expand their business.

Eligibility Criteria for Middle-Market Companies

Middle-market companies seeking mezzanine debt financing must possess specific characteristics and meet financial requirements to be considered eligible.

Typical Characteristics of Middle-Market Companies

Middle-market companies are typically defined by their annual revenues falling within a certain range, often between $10 million and $1 billion. These companies have established themselves in their respective industries and show potential for growth and expansion.

Financial Requirements and Performance Metrics

- Stable and predictable cash flow: Mezzanine lenders look for companies with consistent cash flow to ensure they can meet debt obligations.

- Strong management team: Having a capable management team in place is crucial for the success of a middle-market company seeking mezzanine debt financing.

- Proven track record: Companies with a history of steady growth and profitability are more likely to qualify for mezzanine debt.

- Realistic growth projections: Middle-market companies need to demonstrate a clear plan for utilizing the funds from mezzanine debt to achieve growth targets.

Mezzanine Lenders' Evaluation of Creditworthiness

Mezzanine lenders assess the creditworthiness of middle-market companies by conducting thorough due diligence, which includes reviewing financial statements, cash flow projections, and the company's overall financial health. They also consider the company's industry, market position, and competitive landscape to gauge the potential risks and rewards of providing mezzanine debt financing.

Structuring Mezzanine Debt Deals

Mezzanine debt deals for middle-market companies are structured in a way that combines elements of debt and equity financing. These structures allow companies to access capital for growth without diluting ownership significantly.

Typical Structures of Mezzanine Debt Deals

Mezzanine debt deals often involve a combination of subordinated debt and equity participation. The subordinated debt acts as a form of senior debt with a higher interest rate, while equity participation allows the lender to share in the company's success through ownership stakes.

This structure provides flexibility for companies looking to expand without taking on too much risk.

- Subordinated Debt: Mezzanine lenders provide subordinated debt that ranks below senior debt in terms of repayment priority. This debt usually has a higher interest rate to compensate for the increased risk.

- Equity Participation: Mezzanine lenders may also receive equity warrants or options as part of the deal. This allows them to benefit from the company's growth and success by owning a stake in the business.

Terms and Conditions Negotiated Between Parties

When structuring mezzanine debt deals, common terms and conditions that are negotiated between lenders and middle-market companies include:

- Interest Rates: Negotiating the interest rate on the subordinated debt, which is typically higher than traditional senior debt to reflect the increased risk.

- Repayment Terms: Establishing the repayment schedule and terms of the loan, including any balloon payments or flexible structures based on the company's cash flow.

- Covenants: Setting performance metrics and financial ratios that the company must maintain to stay in compliance with the loan agreement.

Role of Equity Participation and Warrants

Equity participation and warrants play a crucial role in mezzanine debt financing by aligning the interests of the lender and the company. By offering equity stakes or warrants, lenders have the opportunity to benefit from the company's growth and success, incentivizing them to support the business in achieving its goals.

Advantages and Disadvantages of Mezzanine Debt Financing

Mezzanine debt financing offers a unique set of advantages and disadvantages for middle-market companies looking to expand their operations. Understanding these can help businesses make informed decisions about their financing options.

Advantages of Mezzanine Debt Financing

Mezzanine debt financing provides several advantages compared to other financing options available to middle-market companies:

- Flexible Terms: Mezzanine debt typically offers more flexible terms compared to traditional bank loans, allowing companies to customize the repayment structure based on their cash flow projections.

- No Dilution of Equity: Unlike equity financing, mezzanine debt does not require business owners to give up ownership stakes in the company, allowing them to retain control and future earnings.

- Higher Loan Amounts: Mezzanine lenders are willing to provide higher loan amounts based on the company's cash flow potential, giving businesses access to more capital for growth initiatives.

- Tax Deductible Interest: The interest payments on mezzanine debt are tax-deductible, providing potential tax benefits to the company.

Disadvantages of Mezzanine Debt Financing

While mezzanine debt financing offers several advantages, there are also potential drawbacks or risks that companies should consider:

- High Interest Rates: Mezzanine debt typically comes with higher interest rates compared to traditional bank loans, which can increase the overall cost of borrowing for the company.

- Subordination: Mezzanine lenders have a subordinate position to senior lenders in case of default, which can lead to limited recourse for the company in challenging financial situations.

- Restrictive Covenants: Mezzanine debt agreements may include restrictive covenants that limit the company's financial flexibility and operational decisions, potentially impacting its growth trajectory.

- Complex Structuring: Structuring mezzanine debt deals can be complex and time-consuming, requiring careful negotiation and documentation to align the interests of all parties involved.

Real-World Examples of Mezzanine Debt Financing

Real-world examples of successful applications of mezzanine debt financing include companies that utilized this funding to support acquisitions, expansion projects, or product development initiatives. On the other hand, unsuccessful applications may involve companies that struggled to meet the high interest payments or comply with the restrictive covenants, leading to financial distress or default on the debt.

Last Point

In conclusion, Mezzanine Debt Financing: Ideal for Expanding Middle-Market Companies opens up a world of possibilities for companies seeking flexible financing options to support their growth initiatives. With its unique structure and benefits, mezzanine debt financing stands as a strategic choice for ambitious middle-market players.

Essential Questionnaire

What are the typical characteristics of middle-market companies eligible for mezzanine debt financing?

Middle-market companies often exhibit stable revenue streams and strong growth potential, making them attractive candidates for mezzanine debt financing.

How do mezzanine lenders evaluate the creditworthiness of middle-market companies?

Mezzanine lenders assess various factors such as cash flow, market position, and management team strength to determine the creditworthiness of middle-market companies.

What are the advantages of mezzanine debt financing compared to other options for middle-market companies?

Mezzanine debt offers companies the flexibility of access to capital without diluting ownership, allowing them to pursue growth opportunities while maintaining control.

Can you provide examples of successful applications of mezzanine debt financing by middle-market companies?

Companies like XYZ Inc. utilized mezzanine debt financing to fund acquisitions and expand their market presence, showcasing the effectiveness of this financing option.