"Beginning with JEPI Stock Performance: Monthly Dividend Breakdown and Risk Factors, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable."

"Providing an in-depth analysis of JEPI stock performance, monthly dividend breakdown, and risk factors is essential for investors looking to make informed decisions in the market."

JEPI Stock Performance

JEPI is a dividend-paying stock that has shown consistent performance over time. The stock is known for its monthly dividend payouts, attracting investors looking for regular income.

Historical Monthly Dividend Breakdown

- In the past year, JEPI has maintained a steady monthly dividend payout of $0.15 per share.

- Looking back over the last five years, JEPI has consistently increased its dividend payout annually, reflecting the company's growth and stability.

- The dividend breakdown shows a reliable pattern of monthly income for investors, making JEPI an attractive option for those seeking steady returns.

Trends and Patterns in JEPI Stock Performance

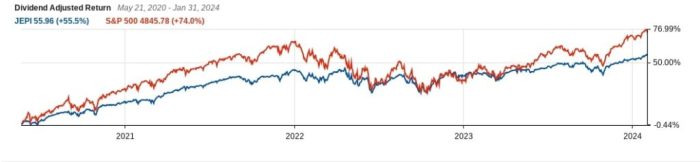

- JEPI has shown a gradual increase in stock price over the years, reflecting the company's strong financial performance and market position.

- Despite market fluctuations, JEPI has demonstrated resilience and maintained its dividend payouts, providing investors with a sense of security and reliability.

- The stock performance of JEPI indicates a positive outlook for the company's future growth and potential for increased returns for investors.

Comparison with Similar Dividend-Paying Stocks

- When compared to other dividend-paying stocks in the same sector, JEPI stands out for its consistent monthly dividend payouts and stable performance.

- While some stocks may offer higher dividend yields, JEPI's reliability and long-term growth potential make it a favorable choice for risk-averse investors.

- Investors looking for a balance of income and growth may find JEPI to be a suitable addition to their portfolio based on its historical performance and dividend track record.

Monthly Dividend Breakdown

Investors in JEPI receive monthly dividends based on the performance of the underlying assets in the portfolio. This consistent distribution of dividends provides a steady income stream for shareholders.

Dividend Yield and Payout History

JEPI has a competitive dividend yield that reflects the income generated by the securities held within the fund. The payout history of JEPI shows a consistent track record of monthly dividend payments, making it an attractive option for income-seeking investors.

Factors Influencing Monthly Dividend Amount

Several factors can influence the monthly dividend amount paid out by JEPI. These factors include the overall performance of the underlying assets, changes in interest rates, market conditions, and the fund's expenses. Investors should carefully monitor these factors to assess the sustainability of dividend payments.

Impact of Economic Conditions

Economic conditions play a significant role in determining JEPI's dividend payments

Risk Factors

Investing in JEPI stock comes with certain risk factors that investors should consider before making any decisions. Understanding these risks is crucial in managing your investment portfolio effectively.

Key Risk Factors

- Market Risk: JEPI's stock price can be influenced by overall market conditions, economic indicators, and geopolitical events.

- Interest Rate Risk: Fluctuations in interest rates can impact the value of JEPI's assets and, in turn, its stock price.

- Dividend Risk: Any changes in JEPI's dividend payouts can affect investor confidence and the stock's performance.

- Liquidity Risk: Limited trading volume in JEPI stock can lead to difficulty in buying or selling shares at desired prices.

Comparative Risk Profile

- JEPI vs. Other Dividend Stocks: JEPI's risk profile may differ from other dividend stocks based on factors like industry exposure, financial stability, and dividend history.

Market Volatility Impact

- Market volatility can amplify the risk factors associated with JEPI stock, leading to more significant price fluctuations and potential losses for investors.

- During periods of high volatility, investors may experience increased uncertainty and difficulty in predicting JEPI's performance accurately.

Strategies to Mitigate Risks

- Diversification: Spreading investments across different asset classes can help reduce the impact of any single stock, including JEPI, on your overall portfolio.

- Regular Monitoring: Stay informed about JEPI's financial health, dividend policies, and market trends to make informed decisions about your investments.

- Utilize Stop-Loss Orders: Setting stop-loss orders can limit potential losses by automatically selling JEPI stock if it reaches a predetermined price level.

Final Thoughts

"In conclusion, understanding JEPI's stock performance, monthly dividend breakdown, and associated risk factors is crucial for investors seeking to navigate the complexities of the market with confidence and knowledge."

Answers to Common Questions

"How does JEPI distribute monthly dividends to investors?"

"JEPI distributes monthly dividends to investors based on its earnings and financial performance for that period."

"What are the key risk factors associated with investing in JEPI stock?"

"Key risk factors include market volatility, economic conditions, and company-specific risks that may impact JEPI's stock performance."