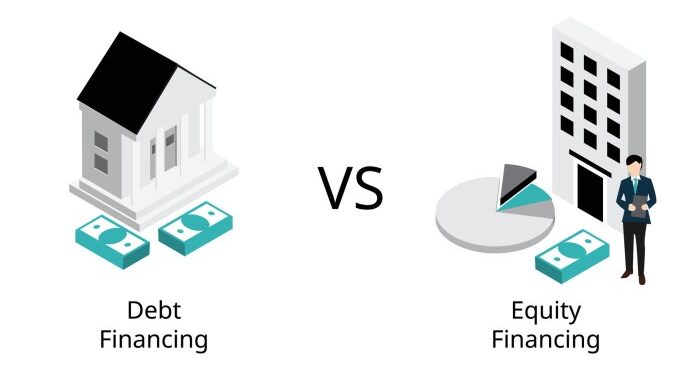

Delving into the realm of Debt Financing vs Equity Financing: Which Is Better for Entrepreneurs?, this introduction sets the stage for a captivating exploration that promises intriguing insights and valuable perspectives.

Providing a detailed overview of the topic, this paragraph lays the foundation for a comprehensive analysis of the two financing options.

Understanding Debt Financing

Debt financing is a method of raising capital by borrowing funds that will need to be repaid over time with interest. This form of financing allows entrepreneurs to access immediate funds without giving up ownership stake in their business.

Types of Debt Financing

- Bank Loans: Entrepreneurs can borrow money from banks with a fixed repayment schedule and interest rate.

- Lines of Credit: A flexible form of borrowing that allows businesses to access funds up to a certain credit limit.

- Corporate Bonds: Companies can issue bonds to investors that will be repaid with interest over a specific period.

Advantages of Debt Financing

- Retain Ownership: Entrepreneurs do not have to give up equity in their business.

- Tax Deductions: Interest payments on debt can be tax-deductible, reducing the overall cost of borrowing.

- Predictable Repayment: Fixed repayment schedules make it easier to budget and plan for the future.

Disadvantages of Debt Financing

- Interest Payments: Debt comes with the cost of interest payments, increasing the overall amount to be repaid.

- Risk of Default: If a business fails to make timely repayments, it can lead to financial difficulties or even bankruptcy.

- Limited Cash Flow: Regular debt repayments can strain cash flow, impacting the ability to invest in other areas of the business.

Exploring Equity Financing

Equity financing is a method of raising capital by selling shares of ownership in a company to investors. In exchange for their investment, shareholders receive ownership stakes in the business and a share of its profits.

Types of Equity Financing

- Venture Capital: Involves funding from venture capital firms that invest in startups and small businesses with high growth potential.

- Angel Investors: Individual investors who provide capital to startups in exchange for equity ownership.

- Private Equity: Investment in mature companies by private equity firms looking to improve operations and grow the business.

Benefits and Drawbacks of Equity Financing

- Benefits:

- Access to expertise: Equity investors often bring valuable experience and industry knowledge to the table.

- No repayment obligation: Unlike debt financing, equity financing does not require regular repayment of principal and interest.

- Potential for rapid growth: With additional capital and support, businesses can scale more quickly.

- Drawbacks:

- Dilution of ownership: Selling equity means giving up a portion of ownership and control in the company.

- Loss of autonomy: Investors may have a say in business decisions, potentially limiting the entrepreneur's freedom.

- Longer funding process: Securing equity investment can be a time-consuming process compared to debt financing.

Decision-making Factors

When choosing between debt and equity financing, entrepreneurs need to carefully consider various factors to make the best decision for their business's financial health and growth. These factors can range from financial risk tolerance to business stage and growth projections.

Financial Risk Tolerance

Entrepreneurs must assess their own financial risk tolerance before deciding between debt and equity financing.

Debt financing involves taking on loans that need to be repaid with interest, increasing financial risk in case of revenue fluctuations or economic downturns.

On the other hand, equity financing involves giving up ownership stake in the company in exchange for funds, which may impact decision-making autonomy. Understanding how comfortable they are with these risks is crucial in choosing the most suitable financing option.

Business Stage and Growth Projections

The stage of the business and growth projections play a significant role in determining whether debt or equity financing is the better choice. In the early stages of a business, when cash flow may be limited, debt financing could burden the company with repayment obligations.

Equity financing, on the other hand, can provide the necessary capital without immediate repayment pressure, allowing the business to focus on growth.

However, as the business matures and becomes more established, taking on debt for expansion or operational needs may be a strategic move, especially if the growth projections are solid.

Legal and Ownership Implications

When it comes to financing options for entrepreneurs, there are significant legal and ownership implications to consider. The choice between debt financing and equity financing can have lasting effects on the structure and control of a business.

Legal Obligations of Debt Financing

Debt financing involves borrowing money that must be repaid with interest over a specified period. Entrepreneurs opting for debt financing are legally obligated to make regular payments to creditors, regardless of the business's performance. Failure to meet these obligations can result in penalties, damaged credit scores, or even legal action.

Ownership Structure and Autonomy with Equity Financing

Equity financing involves selling a portion of the business to investors in exchange for capital. This means that entrepreneurs who choose equity financing will dilute their ownership stake in the company. As a result, decision-making autonomy may shift to investors who now have a say in major business decisions.

Long-Term Implications on Financial Health

In terms of long-term implications, debt financing can lead to increased financial strain due to regular interest payments and the pressure to repay the principal amount. On the other hand, equity financing may provide more flexibility in managing cash flow but could result in a loss of future profits to shareholders.

Flexibility and Cost Analysis

Debt financing and equity financing each offer unique advantages and considerations for entrepreneurs. When evaluating the best option for funding their ventures, understanding the flexibility and cost implications of each type of financing is crucial.

Flexibility of Debt Financing

Debt financing provides entrepreneurs with flexibility in terms of repayment schedules and interest rates. Entrepreneurs can negotiate repayment terms that align with their cash flow projections and business cycles. Additionally, the interest rates on debt financing are typically fixed, allowing entrepreneurs to forecast their future financial obligations more accurately.

Cost Analysis: Debt Financing vs. Equity Financing

Debt financing generally involves lower costs compared to equity financing. While interest payments on debt financing are tax-deductible, equity financing requires entrepreneurs to share ownership and profits with investors, which can be a more expensive long-term commitment. Entrepreneurs should consider the cost of debt in terms of interest payments versus the cost of equity in terms of sharing profits and control.

Cost-Effectiveness Scenarios

- For entrepreneurs with stable cash flows and predictable revenue streams, debt financing may be more cost-effective due to the fixed interest rates and tax advantages.

- In contrast, if entrepreneurs are pursuing high-growth opportunities that require significant investment and have uncertain revenue projections, equity financing might be a more suitable option as it shares the risk and potential rewards with investors.

Summary

Concluding the discussion on Debt Financing vs Equity Financing: Which Is Better for Entrepreneurs?, this final paragraph encapsulates the key points and leaves readers with a thought-provoking conclusion.

Common Queries

What are the key factors to consider when choosing between debt and equity financing?

Entrepreneurs should weigh factors such as financial risk tolerance, business stage, and growth projections to make an informed decision.

How does equity financing impact ownership structure and decision-making autonomy?

Equity financing can dilute ownership and involve sharing decision-making power with investors, impacting the overall control of the business.

In what scenarios might debt financing be more cost-effective than equity financing?

Debt financing could be more cost-effective in situations where interest rates are low, and the repayment schedule aligns well with the business's cash flow.