Exploring the intricacies of loan security in the realm of finance, this guide aims to provide beginners with a solid understanding of the topic. From the significance of loan security for both lenders and borrowers to the types of assets that can be used as collateral, this overview sets the stage for a comprehensive discussion.

As we delve deeper into the concept of loan security, readers will gain valuable insights that will enhance their grasp of this fundamental aspect of financial transactions.

Loan Security Definition

Loan security refers to the assets or collateral that a borrower pledges to a lender to secure a loan. In the context of finance, loan security provides a form of protection for lenders in case the borrower defaults on the loan.

It is a crucial component of lending agreements as it helps mitigate the risk for the lender and provides assurance that they can recover their funds in case of non-payment.

Importance of Loan Security

Loan security is important for both lenders and borrowers. For lenders, it reduces the risk of financial loss by providing a valuable asset that can be used to recoup the loan amount in case of default. This lowers the interest rates offered to borrowers as it decreases the lender's risk.

For borrowers, offering loan security can increase their chances of approval for a loan, especially if they have a limited credit history or lower credit score.

Examples of Assets as Loan Security

- Real estate properties such as homes or land

- Automobiles

- Investment portfolios

- Jewelry and valuable personal belongings

- Equipment or machinery owned by a business

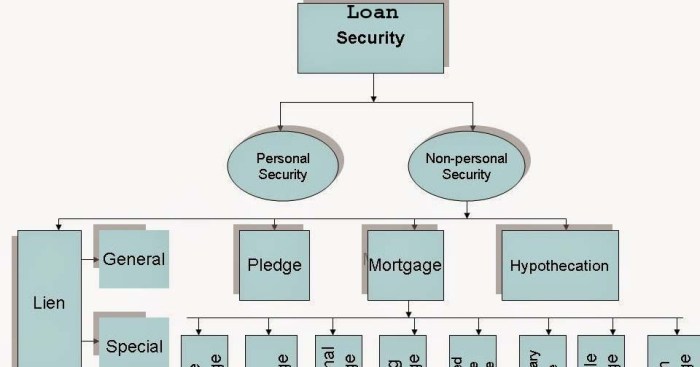

Types of Loan Securities

When it comes to securing a loan, different types of assets can be used as collateral to provide lenders with a form of security. Understanding the various types of loan securities is essential for both borrowers and lenders in the financial industry.

Real Estate

Real estate, such as residential or commercial properties, is one of the most common types of assets used as loan security. The value of the property is assessed by the lender, and if the borrower defaults on the loan, the lender has the right to seize and sell the property to recover the loan amount.

Vehicles

Vehicles, including cars, motorcycles, boats, or other valuable assets, can also be used as loan collateral. In the event of loan default, the lender can repossess the vehicle to cover the outstanding debt.

Stocks and Investments

Stocks, bonds, mutual funds, and other investment portfolios can serve as loan security. The value of these assets is considered when determining the loan amount, and they can be liquidated by the lender if the borrower fails to repay the loan.

Secured vs. Unsecured Loans

Secured loans are backed by collateral, making them less risky for lenders, which often results in lower interest rates for borrowers. On the other hand, unsecured loans do not require collateral, but they typically come with higher interest rates due to the increased risk for lenders.

Collateral and Its Role in Securing a Loan

Collateral is an essential component in securing a loan, as it provides lenders with a form of security against the borrower's default. By offering valuable assets as collateral, borrowers can access larger loan amounts and better terms. However, it's crucial for borrowers to understand the risks involved, as failure to repay the loan can lead to the loss of the collateral.

Benefits of Loan Security

Loan security offers several advantages to borrowers, impacting the terms, interest rates, and access to larger loan amounts.

Impact on Loan Terms and Interest Rates

Having loan security can positively influence the terms and interest rates of a loan

Access to Larger Loan Amounts

Loan security allows borrowers to access larger loan amounts than they might otherwise qualify for. Lenders are more willing to extend higher loan amounts when there is collateral involved, as it reduces their risk exposure. For example, a borrower looking to purchase a home may be able to secure a larger mortgage by offering the property as collateral.

Risks and Considerations

When using assets as loan security, borrowers should be aware of the potential risks involved. Understanding what happens if a borrower defaults on a secured loan is crucial, as well as knowing how to mitigate these risks effectively.

Potential Risks of Using Assets as Loan Security

- Asset Depreciation: The value of the asset used as security may decrease over time, leaving the lender with inadequate collateral.

- Foreclosure Risk: If a borrower defaults on the loan, the lender has the right to seize and sell the asset to recover the outstanding amount.

- Interest Rate Risk: Fluctuations in interest rates can affect the cost of borrowing, potentially leading to financial strain for the borrower.

Consequences of Defaulting on a Secured Loan

- Asset Seizure: In the event of default, the lender can take possession of the asset used as security to recover the loan amount.

- Credit Score Impact: Defaulting on a secured loan can have a negative impact on the borrower's credit score, making it harder to access credit in the future.

- Litigation Risk: Lenders may pursue legal action against defaulting borrowers to recover the outstanding debt.

Tips to Mitigate Risks Associated with Loan Security

- Regularly Monitor Asset Value: Keep track of the value of the asset used as security to ensure it remains sufficient collateral for the loan.

- Stay Updated on Loan Terms: Understand the terms and conditions of the loan, including repayment schedules and potential penalties for default.

- Establish an Emergency Fund: Have a financial cushion in place to cover loan repayments in case of unforeseen circumstances.

Last Word

In conclusion, grasping the concept of loan security is essential for anyone navigating the world of finance. By understanding the benefits, risks, and considerations associated with loan security, individuals can make informed decisions when seeking financial assistance. This guide serves as a stepping stone for beginners to embark on a journey towards financial literacy and empowerment.

Frequently Asked Questions

What assets can be used as loan security?

Assets such as real estate, vehicles, stocks, and even savings accounts can be used as loan security, providing lenders with assurance in case of default.

How does loan security impact interest rates?

Having loan security can lead to lower interest rates as it reduces the risk for lenders, making the loan less risky and more attractive.

What happens if a borrower defaults on a secured loan?

If a borrower defaults on a secured loan, the lender has the right to seize the collateral used to secure the loan in order to recover the outstanding amount.

How can borrowers mitigate risks when using loan security?

Borrowers can mitigate risks by ensuring they can comfortably afford the loan, understanding the terms of the agreement, and maintaining open communication with the lender in case of financial difficulties.