As Financial Issues in Marriage: 7 Money Habits That Destroy Relationships takes center stage, this opening passage beckons readers with engaging insights into a world of financial habits that can make or break relationships.

Let's delve into the dynamics of money habits within marriages and explore how they shape the course of relationships.

Common Money Habits in Marriage

Money habits play a significant role in shaping the dynamics of a marriage. Here are seven key money habits that commonly lead to financial issues in relationships:

1. Overspending

Overspending can strain a marriage as it leads to financial stress, arguments, and lack of trust. Couples may struggle to meet their financial goals and may feel dissatisfied with their financial situation.

2. Keeping Financial Secrets

When one partner hides financial information or makes significant financial decisions without consulting the other, it can lead to feelings of betrayal and mistrust. Lack of transparency can damage the foundation of the relationship.

3. Not Budgeting

A lack of budgeting can result in financial chaos and conflict. Without a clear plan for managing expenses, couples may find themselves constantly arguing over money matters and struggling to make ends meet.

4. Ignoring Debt

Ignoring debt can have long-term consequences on a marriage. High levels of debt can lead to stress, anxiety, and fights over financial responsibilities. It can also hinder the couple's ability to save for the future.

5. Unequal Financial Contributions

When one partner consistently contributes more financially than the other, it can create imbalance and resentment in the relationship. Unequal financial contributions may lead to power struggles and feelings of inadequacy.

6. Impulse Buying

Impulse buying can strain a marriage as it can lead to financial instability and conflict. Couples may find it challenging to stick to a budget and may struggle to save for important goals due to impulsive spending habits.

7. Lack of Financial Goals

A lack of shared financial goals can create misunderstandings and disagreements in a marriage. Without a clear vision for the future, couples may struggle to align their priorities and make decisions that benefit both partners.

Lack of Communication About Finances

Effective communication about finances is crucial in a marriage to ensure transparency, trust, and alignment on financial goals. When couples avoid discussing money matters, it can lead to misunderstandings, disagreements, and financial strain. Lack of communication about finances can create various issues, such as:

Financial Infidelity

- Secretly spending money without informing the partner.

- Hiding debts or financial obligations.

- Making major financial decisions without consulting the other person.

Unequal Financial Contributions

- One partner feeling burdened by the financial responsibilities while the other is unaware or indifferent.

- Unequal distribution of financial resources leading to resentment and imbalance in the relationship.

- Lack of transparency in financial matters causing tension and distrust.

Conflicting Financial Goals

- Not discussing future financial plans and goals, leading to conflicting priorities.

- One partner saving for a goal while the other is unaware or spends money on different priorities.

- Lack of communication resulting in financial decisions that do not align with the couple's shared objectives.

To improve financial communication between partners, it is essential to:

Establish regular financial check-ins to discuss income, expenses, savings, and financial goals.

Be honest and transparent about individual financial situations, debts, and spending habits.

Set mutual financial goals and create a budget together to track progress and make joint decisions.

Financial Infidelity

Financial infidelity occurs when one partner in a relationship hides financial information, lies about money-related matters, or spends money without the knowledge or consent of the other partner. This can have a significant impact on the trust and stability of the relationship.

Common Signs of Financial Infidelity Within a Marriage

- Secret bank accounts or credit cards

- Unexplained withdrawals or expenses

- Hiding bills or financial statements

- Unwillingness to discuss finances openly

- Sudden changes in spending habits

Steps to Rebuild Trust After Financial Infidelity

- Open and honest communication about finances

- Complete transparency in financial matters

- Seeking the help of a financial counselor or therapist

- Setting clear financial goals and boundaries

- Regularly reviewing and discussing financial status and decisions

Different Attitudes Towards Money

When couples have differing attitudes towards money, it can often lead to conflicts within a marriage. These conflicts can arise from differences in spending habits, saving priorities, financial goals, and overall money management styles. It is crucial for couples to address these differences and find common ground to ensure a healthy financial relationship.

Tips for Couples with Different Financial Perspectives

- Communicate openly and honestly about your individual money mindsets. Understanding each other's beliefs and values regarding money is the first step towards finding common ground.

- Identify shared financial goals and priorities. By focusing on common objectives, couples can work together towards a shared vision for their financial future.

- Practice active listening and empathy. It is essential to respect each other's perspectives and feelings towards money, even if they differ from your own.

- Seek professional guidance if needed. Financial advisors or couples' therapists can help facilitate discussions and provide strategies for navigating conflicting money attitudes.

The Importance of Compromise

Compromise is key when dealing with varying attitudes towards money in a marriage. Both partners may need to adjust their financial behaviors and attitudes to meet halfway and create a mutually satisfying financial plan.

- Find a balance between individual preferences and shared financial responsibilities. Compromise may involve making small sacrifices to accommodate each other's needs and preferences.

- Set clear boundaries and expectations. Establishing guidelines for managing money can help prevent misunderstandings and conflicts in the future.

- Regularly revisit and reassess your financial plan. As circumstances change, it is important to adapt and adjust your approach to money management to ensure continued harmony in your relationship.

Keeping Secrets About Finances

Keeping financial secrets from a spouse can have detrimental effects on a marriage. It is important to understand why individuals may choose to keep such secrets and the consequences of doing so.

Reasons for Keeping Financial Secrets

- Embarrassment or shame about past financial mistakes

- Desire to maintain a sense of independence

- Fear of judgment or conflict with their partner

- Feeling the need to protect their partner from financial stress

Consequences of Hiding Financial Information

- Breakdown in trust and communication within the marriage

- Financial infidelity leading to resentment and betrayal

- Inability to plan and work towards common financial goals

- Potential legal issues if financial secrets are uncovered

Guide to Fostering Transparency in Financial Matters

In order to promote openness and honesty in financial matters within a marriage, consider the following:

- Establish regular financial check-ins to discuss budgets, expenses, and goals openly

- Encourage a judgment-free environment where both partners can share their financial concerns

- Create joint financial goals and work towards them together

- Seek the help of a financial counselor or advisor if needed to facilitate discussions

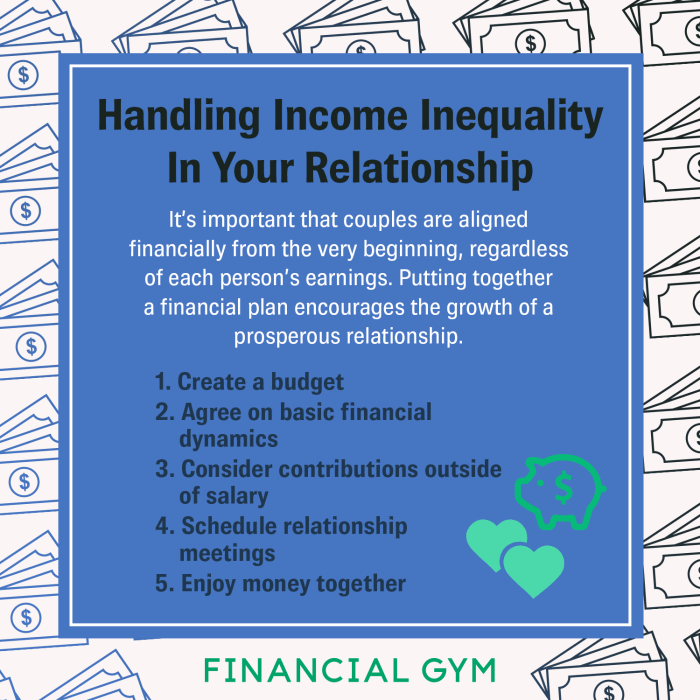

Unequal Financial Contributions

Unequal financial contributions in a marriage can create tension and resentment between partners, leading to conflicts and misunderstandings. It can stem from various factors such as differences in income levels, career paths, or financial responsibilities.

Impact on Marriage

Unequal financial contributions can lead to feelings of inadequacy or superiority, affecting the dynamics of the relationship. The partner who earns less may feel undervalued or dependent, while the higher-earning partner may experience pressure or resentment for carrying a heavier financial burden.

Effective Navigation

- Open Communication: Discuss openly and honestly about financial expectations, goals, and concerns to reach a mutual understanding.

- Equitable Distribution: Create a fair and transparent system for managing finances, considering both partners' contributions and needs.

- Joint Decision-Making: Involve both partners in financial decisions to ensure transparency and accountability.

- Seek Professional Help: Consider consulting a financial advisor or counselor to navigate financial disparities and strengthen the relationship.

Role of Equality

Equality in financial responsibilities is crucial for maintaining balance and harmony in a marriage. Both partners should contribute to the best of their abilities, recognizing and respecting each other's financial circumstances and efforts. It fosters a sense of partnership and teamwork, enhancing trust and mutual support in the relationship.

Neglecting Financial Goals

Setting and working towards financial goals as a couple is crucial for the long-term success of a marriage. Without clear goals, couples may struggle to make informed decisions about their finances, leading to misunderstandings, arguments, and stress.

Importance of Financial Goals in Marriage

- Financial goals provide a sense of direction and purpose, helping couples make joint decisions that align with their shared vision for the future.

- Having clear goals can promote transparency and accountability in financial matters, fostering trust and teamwork in the relationship.

- Working towards common financial objectives can strengthen communication and collaboration between partners, improving overall relationship satisfaction.

Examples of Strain Caused by Neglecting Financial Goals

- Couples may find themselves constantly living paycheck to paycheck without a clear plan for saving or investing for the future, leading to financial stress and instability.

- One partner may prioritize individual spending habits over shared financial goals, causing resentment and conflict within the relationship.

- Without agreed-upon goals, couples may struggle to make major financial decisions together, resulting in missed opportunities and regrets down the line.

Strategies for Aligning Individual Aspirations

- Initiate open and honest conversations about each other's financial values, priorities, and long-term aspirations to identify common ground.

- Create a shared vision board or financial plan that incorporates both partners' individual goals and aspirations, finding ways to align them into a cohesive strategy.

- Regularly review and adjust financial goals together, celebrating milestones achieved and recalibrating when necessary to stay on track towards a shared financial future.

Conclusion

In wrapping up our discussion on Financial Issues in Marriage: 7 Money Habits That Destroy Relationships, we've uncovered crucial insights into the impact of financial behaviors on the fabric of relationships. Take these learnings with you as you navigate the intricate dance between money and love.

Common Queries

What are common money habits that can lead to financial issues in marriages?

Some common money habits include overspending, hiding purchases, or having differing attitudes towards saving and spending.

How can couples rebuild trust after experiencing financial infidelity?

Rebuilding trust after financial infidelity involves honest communication, financial transparency, and a commitment to working through the issues together.

Why is it important for couples to set and work towards financial goals together?

Setting and working towards financial goals together helps couples align their priorities, build a shared future, and strengthen their bond through common aspirations.